This Australian GST calculator adds 10% to determine a GST-inclusive amount, and also allows a reverse calculation to determine an included GST amount, or the price without GST included.

The GST rate is normally 10% of taxable value. To add GST, multiply the price by 1.1. To find a price excluding GST (reverse calculator), divide the price by 1.1

Australian GST Calculator

%Add GST

Calculated GST: $10.00

GST Inclusive value: $110.00

Subtract GST

Subtract the GST: $-9.09

GST Exclusive value: $90.91

How To Calculate GST In Excel

Excel spreadsheet with GST formulae free to download

FAQ

What is GST Turnover?

GST Turnover only includes sales on which GST is payable. Annual GST Turnover (actual or estimated) is the measure used for determining whether GST registration is required.

Expenses are not included when measuring GST Turnover.

GST Turnover does not include any sales which are not subject to GST, such as sales of certain fresh foods, education services, financial services and goods and sales not connected with Australia such as exports.

The GST Turnover test does not apply to taxi and ride sharing operators who are required to register for GST regardless of turnover level.

See further detail: What is ‘GST turnover?

How do I calculate GST from a total?

How do you calculate GST in Australia?

The GST rate is normally 10%.

To add GST to a price, or to a total of prices, simply multiply the price or total by 1.1.

Example: If the Price = $10, then the Price including GST is $10 x 1.1 = $11.

The online GST calculator (upper section) performs this calculation.

[top]

How do I reverse calculate GST in Excel?

How do you subtract GST from a total?

If you know GST is included in an amount, and want to know how much it is, or what the price is without GST included, the reverse formula is used.

The formula is to divide the GST-included invoice amount by (1 + the GST rate). If the GST rate is 10% (it is usually), then divide by 1.1.

The online GST calculator (lower section) performs this calculation.

Examples:

An invoice valued at $11 divided by 1.1 is $10 excluding GST. The GST amount in this case is $1.

If the price including GST is $15, then the price excluding GST is ($15 ÷ 1.1) = $13.64. The GST amount in this case is ($15 – $13.64) = $1.36.

[top]

Do I have to pay GST if I earn under $75,000?

Do I need to register for GST?

The $75,000 annual GST Turnover is the level at which small businesses are required to register for GST, and pay GST collected to the Tax Office.

The GST Turnover registration threshold for non-profit entities is $150,000.

The GST Turnover test does not apply to taxi and ride sharing operators who are required to register for GST regardless of turnover level.

For other entities below the threshold, registration is optional.

Being registered for GST (or required to be registered) means collecting GST on sales to customers. Before paying this to the Tax Office, the business can deduct any GST included in business expenditure, and only the difference is paid to the Tax Office, or if the credits exceed GST owed, the business gets a refund.

Whether or not GST applies to a transaction depends on the nature of the good or service, and whether the provider or vendor is registered for GST.

Certain transactions are not subject to GST, such as sales of certain fresh foods, education services, financial services and goods and services which are exported. There’s a detailed listing here.

[top]

Who has to pay GST?

As a consumer of goods or services which are subject to GST, and not being registered for GST, you will pay the GST which has been included in the purchase price when something is sold to you. The GST is not normally paid separately, it is just part of the price.

The business entity which made the sale to you, will pay the GST collected from sales to the Tax Office at the end of their reporting period, and after offsetting any GST paid to other vendors for their business supplies. (If credits exceed the GST owed, the net amout is refunded to the business).

A business which is not registered for GST (or not required to be) will not include GST in its pricing, but will pay the GST included in the cost of purchases from suppliers. In that case there is no credit for the GST paid.

[top]

How much GST does a small business pay?

The answer to that depends on how small the business is. Size for GST purposes is measured by GST Turnover, which is the annual sales of items on which GST is payable.

If the GST Turnover of the business is under $75,000 ($150,000 for non-profits) then the business is not required to be registered (it is optional). If not registered, the business does not collect GST from its sales, and the only GST paid is that included in purchases from suppliers, for which there is no credit. The normal rate of such GST is 10% of the invoice value.

If the small business is registered for GST, then GST is added to its sales invoices at the rate of 10%. The GST collected is paid the the Tax Office after offsetting GST included in invoices from suppliers.

[top]

Are My Sales Taxable (GST-Free or Input-Taxed)?

GST applies to most goods and services at the rate of 10% added to the sales invoice value. However there are a number of important exceptions.

GST-free sales include a number of items listed as non-taxable, and for which credits are available for GST included in the cost of sales.

Examples of GST-free sales include health and medical services and supplies, education, the sale of a business as a going concern, cars for disabled persons and exported sales to overseas customers. There is a list of GST-free items on this page.

Fresh food items may also be GST-free, but the determination of taxability requires a careful description of the food and how it is provided.

For example unfilled Turkish bread and rolls are GST-free, whereas filled Turkish bread and rolls are considered taxable. This example was taken from the Tax Office’s GST food and beverage search tool, searching for “bread”.

The search tool is used in conjuction with the Detailed Food List and food classification in order to accurately determine the tax status of a food item.

Input-taxed sales also do not attract GST, but they differ from GST-free sales in that the GST included in costs of sales is not claimable as a credit.

The most common examples of input-taxed sales are financial supplies, and selling or renting out residential premises.

Loan interest, bank charges and similar are financial supplies.

A sale of residential premises is an input taxed sale, unless new or substantially renovated (subject to a 5 year rule), or as part of a commercial business. The rules around residential premises are set out in detail here: Residential premises

If a supply is both wholly GST-free and wholly input taxed, then the supply is treated as being GST-free and not input taxed.

See here for a comprehensive details of GST-free and input taxed items.

[top]

How Do I Pay GST?

Cash or Accruals Method?

GST from your sales is required to be totalled and sent to the Tax Office on a periodic basis.

How often will depend on your registration setup, but for most small businesses, Business Activity Statements (“BAS”) are compiled from bookkeeping records and filed on a quarterly basis.

Most popular bookkeeping software solutions can generate BAS reports, and may also have electronic lodgement and payment functions.

Penalties are automatically applied if a BAS return due date is exceeded.

The BAS return also contains details of other amounts, such as PAYG, owed to the Tax Office. If the BAS return total shows that you owe money to the Tax Office, the payment will be required no later than the lodgement due date.

If credits claimed exceed the amounts payable, a refund normally issues from the Tax Office promptly to your nominated bank account.

The Tax Office encourages use of their electronic portals for lodgment of Activity Statements, and the settlement of amounts due by electronic payment. However, the paper return option, at the time of writing is also still available. Lodgement options and mailing details are listed here.

Smaller businesses (aggregated turnover of less than $10 million) making sales on credit need to take particular care of cash flow. They have a choice of preparing their BAS returns on a cash basis, declaring only sales and expenses which had been settled by period end, or on an accrued basis.

The alternative method (‘accruals basis’) is used by larger companies, and requires that GST on invoices not yet paid (both payable and receivable) be submitted.

The best choice for smaller businesses requires some analysis of cash flows, and is influenced by such factors as the GST-free proportion of sales, and the magnitude of credit purchases compared to credit sales.

There is detailed information on accounting methods and cash method eligibility here.

This calculator provides a way to compare Cash and Accrual calculations (for a single period) which may be useful in assessing the impact of each method based on assumptions.

[top]

Cash Vs Accruals Method Decision Tool

Enter accrual and cash sales and purchases for a period to calculate the BAS return outcomes for comparison. Negative values indicate a BAS refund or credit. Positive values indicate BAS amount payable.

BAS Balance: Cash vs Accrual

Negative values indicate a BAS refund or credit. Positive values indicate BAS amount payable

When did GST start in Australia?

1 July 2000. See A New Tax System (Goods and Services Tax) Act 1999

[top]

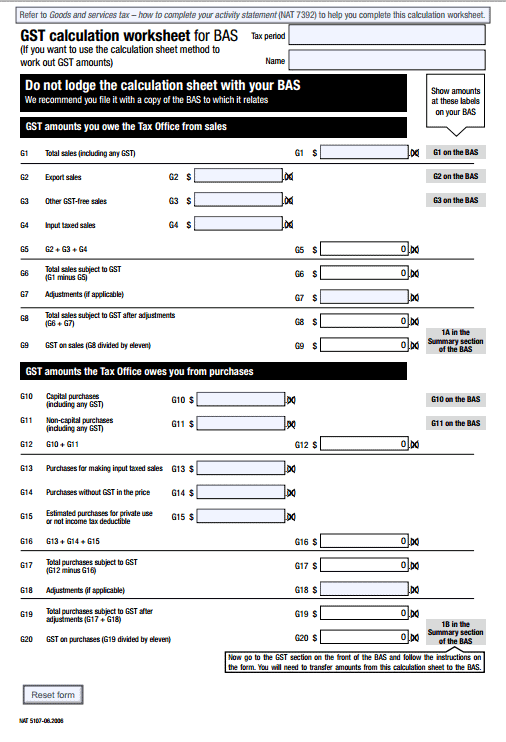

GST calculation worksheet

Click here or the image below for a GST calculation worksheet for BAS (activity statement) purposes. The form is fillable online or downloadable to your desktop.

GST – Further Information

This page was last modified 2021-07-20